Now, I am about to give you the DETAILED guide of $30 An Hour Is How Much A Year Before Tax and After Tax.

I have recently explored and added all the pieces of information in this article (which is running in 2023)

On the way, I’ll show you some jobs that can make you more than $30 an hour regardless of degree.

Let’s submerge right in

$30 An Hour Is How Much A Year

Working without knowing how much you are going to earn annually with a $30 an hour salary seems, like jumping into a pond whose depth is unknown.

It’s important to have an idea that if you would work those hours you would earn this amount of money.

Your annual earnings are directly dependent on how many hours you work each day whether full-time or part-time.

In the case of full-time, if you work 40 hours a week, every year has 52 weeks, meaning you will have worked an average of 2,080 hours annually.

On the other side, if you prefer to work 25 hours a week as a part-time employee, you will have worked 1,300 hours annually.

So mathematically to calculate your annual salary as a full-time employee making $30 an hour, you will need to multiply the total number of hours you will work annually by $30, as a result, you will earn $62,400 a year.

For part-time employees, similarly, multiply your annual hours by $30, it means you will have $39,000

Even so, these are just an overview of how much you earn without considering tax, overtime, unpaid leaves, and more.

$30 An Hour Is How Much A Year After Tax

Let’s have an accurate calculation by applying all possible taxes on your salary.

The amount I have calculated is called Gross Income (which has tax and your income after tax).

To know your net income, you’ll need to subtract all the taxes that will broadly decrease your annual income.

In the United States, there are Federal Income Taxes, State Income Taxes, and Medicare And Social Security Taxes.

Federal income tax is conducted by the Federal Government to fund public services.

To calculate Federal Tax, you need to subtract the deduction from your gross income

The standard deduction for single filters in 2023 is $13,850

You earn $30 an hour, which equals $62,400 annually. When you subtract $13,850 from your annual earnings, the amount comes to $48,550 which is the taxable income (The amount which is only responsible for tax).

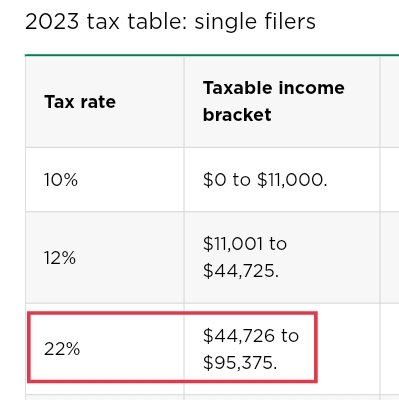

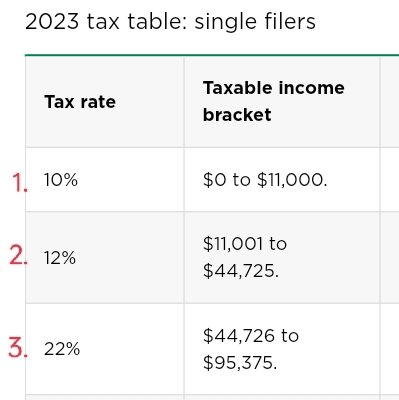

According to the tax bracket, your annual income falls in the 22% tax rate category.

Out of your taxable income ($48,550), $11,000 will be taxed at 10% which is equal to $1,100.

source: nerdwallet.com

From $11,001 to $44,725 of your taxable income will be text at 12%, meaning 12% of $33,725, which is equal to $4,047

Your remaining taxable income is in the $44,726 to $95,375 range and will be taxed at 22%, which means 22% of $3,825 which is $841.5.

After adding all taxes I calculated above, I found the estimated Federal Income Tax for a single is $5,988.5 as of 2023.

Remember, as long as your salary increases, whether you are single, married, or head of household, your tax will also increase.

Now I have only familiarized you with Federal Income Tax. The Medicare and Social Security Taxes will also reduce your income.

Additionally depending upon which state of the United States you are currently living, the State Income Tax will also decrease your annual earnings.

What’s the catch?

To figure out the total tax according to in which states you are in, you will have to suffer from boring calculations and searchings. it’s difficult to find all information in one place, but until now

The solution?

I have explored and done all the work for you if you are a single having a $62,400 annual salary, you will get everything in one table from Total Tax Percentage (Which is the percentage of total tax over your annual income), State Tax (That’s influenced by the state you are living), Total Tax Due (Total possible taxes) and Take Home Pay (The amount you’ll get after all taxes).

The reason I didn’t make separate sections for Federal, Social Security, and Medicare taxes is, these taxes do not vary, they always remain the same.

If you want to examine the table, I have included Social Security Tax = $3,869, Medicare Tax = $905, and early I calculated Federal Tax = $5,988.

| State | Total Tax (%) | State Tax | Total Tax Due | Take-Home Pay |

|---|---|---|---|---|

| Alabama | 21.8% | 2,855 | 13,617 | 48,783 |

| Alaska | 17.2% | 0 | 10,762 | 51,638 |

| Arizona | 19.2% | 1,214 | 11,976 | 50,424 |

| Arkansas | 21.6% | 2,755 | 13,517 | 48,883 |

| California | 20.5% | 2,051 | 12,813 | 49,587 |

| Colorado | 20.6% | 2,136 | 12,898 | 49,502 |

| Connecticut | 20.7% | 2,170 | 12,932 | 49,468 |

| Delaware | 21.7% | 2,786 | 13,548 | 48,852 |

| District Of Columbia (DC) | 21.7% | 2,756 | 13,518 | 48,882 |

| Florida | 17.2% | 0 | 10,762 | 51,638 |

| Georgia | 22% | 2,950 | 13,712 | 48,688 |

| Hawaii | 23.9% | 4,126 | 14,888 | 47,512 |

| Idaho | 21.8% | 2,816 | 13,578 | 48,822 |

| Illinois | 22% | 2,969 | 13,731 | 48,669 |

| Indiana | 20.3% | 1,934 | 12,696 | 49,704 |

| Iowa | 22.4% | 3,228 | 13,990 | 48,410 |

| Kansas | 21.7% | 2,772 | 13,534 | 48,866 |

| Kentucky | 21.5% | 2,683 | 13,445 | 48,955 |

| Louisiana | 20.3% | 1,880 | 12,642 | 49,758 |

| Maine | 21.6% | 2,727 | 13,489 | 48,911 |

| Maryland | 21.5% | 2,646 | 13,408 | 48,992 |

| Massachusetts | 21.9% | 2,900 | 13,662 | 48,738 |

| Michigan | 21.2% | 2,440 | 13,202 | 49,198 |

| Minnesota | 21.8% | 2,867 | 13,629 | 48,771 |

| Mississippi | 20.8% | 2,205 | 12,967 | 49,433 |

| Missouri | 20.8% | 2,233 | 12,995 | 49,405 |

| Montana | 22% | 2,982 | 13,744 | 48,656 |

| Nebraska | 21.3% | 2,508 | 13,270 | 49,130 |

| Nevada | 17.2% | 0 | 10,762 | 51,638 |

| New Hampshire | 17.2% | 0 | 10,762 | 51,638 |

| New Jersey | 20.3% | 1,900 | 12,662 | 49,738 |

| New Mexico | 20.6% | 2,099 | 12,862 | 49,538 |

| New York | 21.8% | 2,827 | 13,589 | 48,811 |

| North Carolina | 21% | 2,358 | 13,120 | 49,280 |

| North Dakota | 18.2% | 598 | 11,360 | 51,040 |

| Ohio | 18.9% | 1,003 | 11,765 | 50,635 |

| Oklahoma | 21.1% | 2,426 | 13,188 | 49,212 |

| Oregon | 24.8% | 4,711 | 15,473 | 46,927 |

| Pennsylvania | 20.3% | 1,916 | 12,678 | 49,722 |

| Rhode Island | 20.1% | 1,789 | 12,551 | 49,849 |

| South Carolina | 21.3% | 2,498 | 13,260 | 49,140 |

| South Dakota | 17.2% | 0 | 10,762 | 51,638 |

| Tennessee | 17.2% | 0 | 10,762 | 51,638 |

| Texas | 17.2% | 0 | 10,762 | 51,638 |

| Utah | 22% | 2,986 | 13,748 | 48,652 |

| Vermont | 20.5% | 2,023 | 12,785 | 49,615 |

| Virginia | 21.8% | 2,817 | 13,579 | 48,821 |

| Washington | 17.2% | 0 | 10,762 | 51,638 |

| West Virginia | 21.7% | 2,801 | 13,563 | 48,837 |

| Wisconsin | 20.9% | 2,261 | 13,023 | 49,377 |

| Wyoming | 17.2% | 0 | 10,762 | 51,638 |

I assume you have known your annual tax and have an idea of $30 an hour is how much a year after tax.

Let’s make chunks of your $30 in an hour annual earnings into hours, days, weeks biweekly, and months and find what we would get after taxes.

$30 An Hour Annual Salary Break Up

The calculation of a $30 dollar per hour annual salary a year, month, biweekly, week, and day, becomes crucial when you are hired for a different time range or you want to work as you can.

By making sure how much you will get, you can further change your working duration according to your expenses and lifestyle.

$30 an Hour Is How Much a Year After Taxes

I’ve estimated above that a $30 an hour salary equals $62,400 annual income or gross income without tax.

But this is not the exact amount you will get at the end of the year.

Let’s take the help of the table given above, After pondering all applicable taxes, your Total Tax would be between 17% to 24% of your gross income.

In which the states of Alaska, Florida, Nevada, New Hampshire, South Dakota, Tennessee, Texas, Washington, and Wyoming have zero State Tax.

If you live there your annual income will be taxed at %17.2 of your annual salary which is less than the rest of all states.

Moreover, In the case of a full-time employee, the annual income after tax would be between $44,000 to $54,000, or you can say $49,283 net income on average.

On the other hand, if you work part-time, your net annual income would be nearly $33,219 in 2023.

$30 an Hour Is How Much a Month After Taxes

For a full-time worker, if you get $30 an hour, your monthly gross income will be $5,200 after subtracting tax, you will earn $4,303 per month.

Further, if you are a part-time employee, your monthly gross income will go to $3,250 and will become $2,768 per month after tax.

$30 an Hour Is How Much Biweekly After Taxes

If you work full-time for two weeks, you will have a gross income of $2,440 before tax, after applying tax you will have a $2,019 biweekly salary.

Mathematically, your biweekly income will be $1,500 if you work part-time, after tax you will have $1,278.

$30 an Hour Is How Much a Week After Taxes

If you work 40 hours a week, your salary before tax will be $1,200, after tax, it will be $993 per week.

As well, for part-time workers who work 25 hours a week, the gross income before tax will be $750 and will become $639 per week after tax.

In case, you work 20 hours a week as a part-time, your income before tax will be $600, and after tax, it will be $518.

$30 an Hour Is How Much a Day After Taxes

For full-time workers, If you work 8 hours a day, the gross income will be $240, it’ll be $199 after tax.

Next, if you work part-time, meaning 5 hours a day, you’ll have $150 as a gross income, and will be $127.8 after tax subtraction.

As if that’s not enough

How The Cost Of Living Can Affect Your $30 An Hour Salary

When budgeting and saving $30 an hour, it’s important to know how the cost of living can impact your savings because different cities and regions in the USA have different costs of living

so, your salary’s purchasing power can differ broadly depending on where you live.

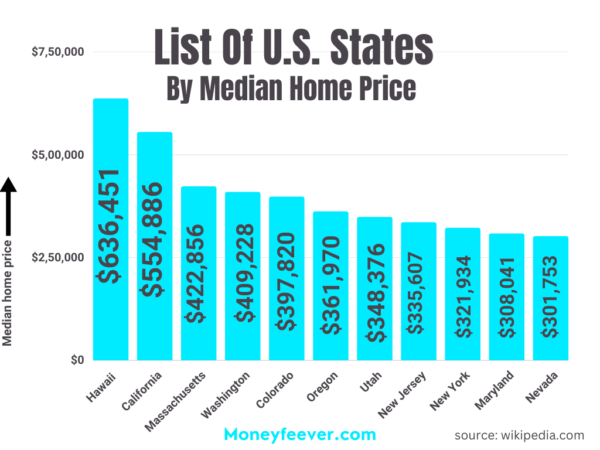

House Costs: The biggest factor that can influence the cost of living is usually housing in big cities or high-demand areas. The cost of rent or housing prices can be solid if you live in an expensive city.

A big portion of your $30 an hour salary may go toward rent or mortgage payments, which can leave you with less income.

Food And Groceries: This is the crucial thing because without food no one wants to stay hungry. The cost of groceries can vary depending on the region and eating out can be more expensive in certain areas. If you have a family to support you will have to perceive these expenses.

| Rank | State | Food Cost ($) |

|---|---|---|

| 1 | Hawaii (Honolulu) | $556.76 |

| 2 | Vermont (Burlington) | $497.41 |

| 3 | Alaska (Anchorage) | $483.24 |

| 4 | New York (New York City) | $482.87 |

| 5 | West Virginia (Charleston) | $427.19 |

| 6 | Mississippi (Jackson) | $423.33 |

| 7 | South Carolina (Charleston) | $411.29 |

| 8 | Massachusetts (Boston) | $406.21 |

| 9 | District of Columbia (Washington DC) | $405.08 |

| 10 | Washington (Seattle) | $402.08 |

The table displays the top 10 states with the highest food costs, along with the respective average monthly food cost in dollars ($). The costs are based on specific cities in each state where data is available.

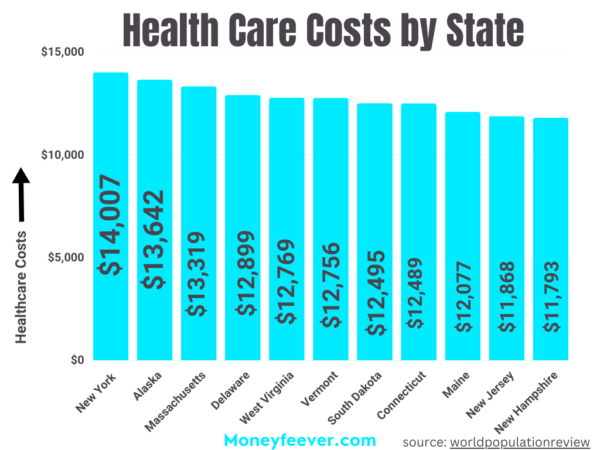

Healthcare: No matter how much money you earn, without health there is nothing.

The cost of health can vary depending on your employee’s health Insurance coverage or if you need to purchase private insurance. Medical expenses, including insurance premium deductibles, and copays, can be a considerable factor.

Education: If you have children or are planning to pursue higher education, the cost of schooling or college tuition can be an important consideration.

Average Cost of In-State Tuition & Fees In Different States

| RANK | STATE | IN-STATE TUITION & FEES |

|---|---|---|

| 1 | Vermont | $17,593 |

| 2 | New Hampshire | $16,749 |

| 3 | Pennsylvania | $14,532 |

| 4 | Illinois | $14,579 |

| 5 | New Jersey | $14,184 |

| 6 | Connecticut | $14,487 |

| 7 | Massachusetts | $13,939 |

| 8 | Virginia | $13,931 |

| 9 | Michigan | $13,716 |

| 10 | Rhode Island | $13,697 |

The table shows the top 10 states ranked by their in-state tuition and fees for education. The tuition and fees values are listed in dollars ($) per year for each state.

So you peeked at how much expenses are according to different states.

Let’s catch up on how to budget with PRACTICAL EXAMPLES:

How To Budget Your $30 An Hour Salary

For most people, living without a budget seems like driving a car without knowing how much fuel is left.

It’s important to budget your $30 an hour salary in a manner you will live a comfortable life with a good financial future.

Here’s the step-by-step process:

Step #1

List All Essential Expenses

Firstly, you need to identify and list all of your essential monthly expenses for maintaining a well living and cowering your needs.

To create a detailed list of essential expenses, follow these guidelines:

1. Housing: Start with your rent or mortgage payment. If you rent, include the monthly rent amount. If you have a mortgage, consider the principal, interest, property taxes, and homeowners’ insurance.

2. Utilities: List all the regular utility bills you pay each month, such as electricity, water, gas, and internet. These expenses are typically fixed or semi-variable.

3. Transportation: Include the costs associated with getting to work or traveling, such as car payments (if you have a car loan), car insurance, fuel, public transportation passes, or ride-sharing expenses.

4. Groceries: Estimate your monthly spending on groceries and household essentials. This amount can vary based on your eating habits, family size, and location.

5. Health Insurance and Medical Expenses: Account for health insurance premiums and any regular medical expenses like copays for prescription medications.

6. Minimum Debt Payments: If you have any outstanding debts like student loans, credit card debt, or personal loans, include the minimum monthly payments.

7. Basic Clothing: Allocate a portion of your budget for essential clothing items like work attire, shoes, and other necessities.

8. Other Necessary Expenses: This category may include items like childcare or support payments, necessary home repairs, and any other essential monthly costs specific to your situation.

Once you have your list of essential expenses, you can continue to Step 2, where you’ll categorize these expenses and create a budget that aligns with your $30 an hour salary.

Step #2

Rate Fixed and Variable Expenses

In this step, you will categorize your essential expenses into fixed and variable categories.

Having a clear difference between fixed and variable expenses allows you to adjust your spending in certain areas if needed and helps you plan for the month ahead with more accuracy

1. Fixed Expenses: Fixed expenses are those that remain relatively stable each month, meaning the amount you spend on them doesn’t fluctuate considerably. These expenses are usually necessities and typically have a set amount that you can predict in advance.

For example:

Let’s say your fixed expenses include the following:

- Rent/Mortgage: $1,500 per month

- Utilities (electricity, water, internet, etc.): $200 per month

- Health Insurance: $300 per month

In this example, the total fixed expenses amount to $2,000 per month. These expenses remain constant month to month, and you can plan your budget accordingly.

2. Variable Expenses: Variable expenses are those that can change from month to month and depend on factors like lifestyle choices, consumption patterns, or specific needs. They might be necessary, but the amounts can fluctuate.

Example:

Let’s consider the following variable expenses:

- Groceries: $400 per month (This can vary depending on your food choices and family size.)

- Transportation: $200 per month (This may vary if you use public transit or have extra travel needs in some months.)

- Clothing: $100 per month (This can fluctuate based on whether you need to buy new clothes that month or not.)

- Other Necessary Expenses: $300 per month (This may include items like home repairs or other essential costs that don’t have a fixed amount.)

In this example, the total variable expenses amount to $1,000 per month. These expenses may vary each month but are essential to include in your budget.

So I suppose you have listed variable and fixed expenses it’s time to dip into Step 3 where you will create a budget by using the list you’ve made

Step #3

Create A Budget

Creating a budget is a crucial step in managing your entire finances. A budget helps you allocate your income to cover your essential expenses, savings, and financial goals while it also provides a clear picture of your spending habits.

It allows you to track your money and make informed decisions about your financial priorities.

Here’s how to create a budget using your $30 an hour salary with the examples from the previous steps:

1. Calculate Your Total Monthly Income:

I assume you are a full-time worker with having $5,200 gross income, after tax, Monthly Income = $4,303 (approximately)

2. List Your Fixed and Variable Expenses:

Fixed Expenses:

- Rent/Mortgage: $1,500 per month

- Utilities: $200 per month

- Health Insurance: $300 per month

- Total Fixed Expenses: $2,000 per month

Variable Expenses:

- Groceries: $400 per month

- Transportation: $200 per month

- Clothing: $100 per month

- Other Necessary Expenses: $300 per month

- Total Variable Expenses: $1,000 per month

3. Divide Funds for Savings and Financial Goals:

Determine how much you want to save or allocate for your financial goals each month. In this example, let’s aim to save $500 per month.

4. Calculate the Remaining Amount:

- Subtract your total fixed and variable expenses, along with your savings, from your monthly income:

- Remaining = Monthly Income – (Total Fixed Expenses + Total Variable Expenses + Savings)

- Remaining = $4,303 – ($2,000 + $1,000 + $500)

- Remaining = $803

5. Optional Spending:

The remaining amount of $803 can be used for optional spending, such as entertainment, dining out, hobbies, and other non-essential expenses.

By following this budget, you ensure that your $30 an hour salary is effectively allocated to cover all your essential expenses, savings, and financial goals.

If you don’t know, how to make money while sleeping, you will work until you die

That’s why I want to show you:

How To Grow Your $30 An Hour Salary By Investing

Only saving money cannot lead you to live a life of financial freedom. If you start investing earlier, a portion of your savings after allocating an emergency fund can secure your future and can pass your wealth to the next generation.

Let’s see where to grow your money:

1. Index Fund

The index fund is the combination of many companies that track the performance of well-established and known companies with strong financial assets, or specific markets such as (the S&P 500, Dow Jones Industrial Average, or Nasdaq).

Instead of actively selecting individual stocks, index funds passively invest in a diversified portfolio of securities which is the composition of the target market.

2. Mutual Fund

As an Index fund, mutual funds pool money from many investors to invest in a diversified portfolio of stocks, bonds, or other securities. The difference is they are managed by professional fund managers who have decades of experience in investing.

With active management, Mutual funds may have the potential to deliver returns that outperform the market. Skilled fund managers may identify undervalued assets to generate attractive returns.

3. Retirement Accounts

The retirement accounts are specifically designed to help you save and invest money for your retirement years. This will offer various tax advantages and incentives to push you and many people to save for retirement and get a more secure financial future.

In the USA, these accounts are regulated by the Internal Revenue Service (IRS).

Here are some common types

1. 401(k) Plan: This is a retirement plan offered by employers to their employees. so you as an employee can contribute a person of your pre-tax salary to the plan that reduces your taxable income for the year.

2. IRA: It’s called Traditional Individual Retirement Account, which allows you to contribute pre-tax income that reduces your taxable income for the year.

3. Roth IRA: Roth Individual Retirement Account is another account that differs from the IRA in terms of tax treatment. Contributions to Roth IRA are made with after-tax income, meaning they do not reduce your taxable income for the years.

So pick any option you want and invest consistently regardless of market fluctuations, it’s crucial for long-term growth.

If possible, Set up automation contributions to your investment account to ensure regular investing.

Do you want to know what possible jobs are there that can pay you $30 an hour or more?

What Jobs Pay $30 An Hour

Below are given, where to make $30 an hour

1. Budget Analyst

Average salary: $30.58 per month

By being a budget analyst you will monitor the finances of public and private organizations. This includes monitoring companies’ spending, creating a budget report, estimating the cost of new projects, and determining their potential impact on the overall budget.

2. Business Consultant

Average salary: $30.87 per hour

Businesses hire Business Consultants to analyze their organizations’ performance in order to enhance efficiency.

Business consultants also guide marketing strategies, market research, and sales tactics to help businesses attract and retain customers.

3. Sales Executive

Average salary: $32.14 per hour

A sales executive is a professional responsible for promoting and selling products or services to potential clients. They identify leads, build customer relationships, conduct sales presentations, negotiate deals, and close sales.

Sales executives work to achieve sales targets, collaborate with marketing teams, and maintain client satisfaction to drive business growth.

4. UX Designer

Average salary: $44.67 per hour

A UX designer, short for User Experience designer, is a professional who focuses on creating intuitive and user-friendly digital products.

They analyze user behavior, conduct research, and design interfaces to enhance user satisfaction and usability. UX designers aim to optimize the overall user experience by considering factors such as accessibility, information architecture, and interaction design.

5. Loan Officer

Average salary: $42.19 per hour

A loan officer is a financial professional who assists individuals and businesses in obtaining loans. They evaluate loan applications, assess creditworthiness, and help clients choose suitable loan products.

Loan officers facilitate the loan process, ensure compliance with regulations, and work for banks, credit unions, or mortgage companies.

What Jobs Pay $30 An Hour Without A Degree

1. Construction Inspectors

Average salary: $30 per hour

Construction inspectors are professionals who oversee and inspect construction projects to ensure compliance with building codes, safety regulations, and quality standards. They monitor construction progress, review blueprints, check materials, and inspect workmanship.

Their role is to ensure that construction meets legal and safety requirements, adheres to approved plans, and maintains the expected quality.

2. Subway And Streetcar Operators

Average salary: $32.63 per hour

Subway and streetcar operators are responsible for driving and operating trains and streetcars in urban areas.

They ensure the safe and efficient transportation of passengers along designated routes. Their duties include adhering to schedules, obeying traffic signals, and assisting passengers.

Operators must also monitor train systems and address any emergencies or mechanical issues. Their role is vital in providing reliable public transportation and ensuring the safety and comfort of commuters.

3. Electrical Power Line Installer

Average salary: $31.83 per hour

An Electrical Power Line Installer is a skilled worker who installs, repairs and maintains power lines and electrical cables. They work with high-voltage electrical systems, using specialized equipment to safely connect power sources to homes, businesses, and industries.

They climb poles, install towers, and run cables to ensure a reliable supply of electricity for communities. Their expertise ensures the safe and efficient distribution of electrical power, playing a vital role in maintaining modern infrastructure and enabling the functioning of our electrical grid.

4. Lighting Technicians

Average salary: $35.32 per hour

Lighting technicians are professionals responsible for setting up and operating lighting equipment for various events, productions, or venues. They work in theater, film, concerts, and other entertainment settings.

Lighting techs install and control lights, and adjust brightness, colors, and angles to create the desired ambiance and visual effects.

5. Commercial Pilot

Average salary: $41.38 per hour

A commercial pilot is a licensed professional who operates aircraft for various purposes, such as transporting passengers or cargo, conducting aerial surveys, or performing flight instruction.

They have received advanced flight training and possess a commercial pilot’s license, allowing them to be compensated for their flying services.

Commercial pilots work for airlines, cargo carriers, charter companies, and other aviation-related businesses, ensuring safe and efficient air travel.

Frequently Asked Questions

How much is $30 an hour a day after taxes?

You will get $199 a day.

How much is $30 an hour a week after taxes?

It’s about $993.

How much $30 an hour biweekly after taxes?

If you work biweekly, your salary would be $2,440, After tax, it will be $2,019.

How much $30 an hour a month after taxes?

You will have $4,303 at the end of the month.

Is $30 an hour good in Canada?

Yes, It is close to the average hourly wages in Canada.

Is $30 an hour good in California?

If you are a single adult with no Child, yes $30 an hour is good.

What jobs pay $30 an hour without a degree?

Construction Inspectors, Subway And Streetcar Operators, Electrical Power Line installers, Lighting Technicians, and Commercial Pilots are the jobs that pay $30 an hour or even more.

Conclusion

So, Congratulations because now you are equipped with all considerations related $30 an hour salary.

I have discussed $30 an hour is how much a year, month, biweekly, week, day, and provided jobs that can make you $30 an hour or more regardless of degree.

Now, It’s your turn to let me know how this article benefited you or helped knowing something you wanted to

Feel free to comment below about what did I miss or if you want me to add to this article.

I am always open to answering each query because it’s your blog.