Ever wonder where all your money went at the end of the month? Yes, we have all been there. Managing money can be like attempting to solve a puzzle without all of the components. But do not be afraid! In this digital age, there’s a secret weapon: budget-tracking applications.

In India, where individuals are becoming more aware of their finances, these apps are like superheroes swooping in to save the day. They make budgeting and cost tracking simple. So, let’s take a look at budget tracker applications, where money management goes from headache to high-five with a few touches on your phone.

5 Budget Tracker Apps in India For Streamline Your Spending to Achieve Financial Goals

1. Money View – Expense Manager App

Money View is known for its ability to provide real-time visibility into your finances by reading transactional SMS messages. It is one of the best budget tracker apps as it can categorize your payments easily and help you avoid overspending with weekly and monthly summaries.

It stands for its Smart SMS Tracking technology, which eliminates the need for manual entry and provides real-time financial visibility. This technology is particularly beneficial for users who have multiple bank accounts and find it cumbersome to log into different banking platforms. The app’s PIN-based protection and bank-grade security ensure that all transactions are safe and secure.

Features of Money View

- Automatic Expense Tracking and Categorization: The app uses Smart SMS Tracking technology to automatically categorize your transactional SMSs, giving you a complete view of all your expenses.

- One Passbook for Everything: You can track all your accounts or balances—credit and debit—in a single place, without the need for internet or logging into net banking.

- Easy Budget Tracking: Set a monthly budget and receive alerts to ensure you stay on track with your spending.

- Payment Reminders: Get reminders for all types of bills (credit card, utility, etc.) and conveniently pay them through the app.

- Instant Loan: Check your eligibility online, apply through the app, and you can receive the money in your account in just 2 hours

| Money View | Details |

| iOS | Not Available |

| Android | Rating: 4.5/ 5 stars |

| Cost | Free for everyone |

| Downloads | 10M+ |

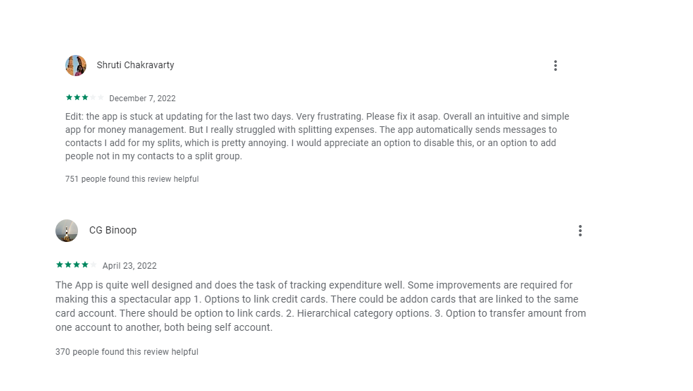

User Reviews

In short, Money View – Expense Manager App is highly regarded for its comprehensive financial tracking capabilities, security features, and user-friendly design. While it offers many benefits, users should also consider the interest rates when exploring the loan options provided by the app. The positive reviews suggest that it is a reliable tool for managing personal finances and staying on top of expenses.

2. Goodbudget – Budget & Finance App

Goodbudget is the best budget tracker app that uses the envelope system for budgeting. The envelope system is a time-tested approach that encourages disciplined spending and saving. The app’s ability to sync across devices is beneficial for couples or families who want to manage their finances jointly. Additionally, the manual entry of transactions can be seen as a more secure way to manage finances, as it does not require bank linking.

Features of Goodbudget

- Envelope Budgeting System: Goodbudget is based on the traditional envelope budgeting method, which helps users allocate every dollar of their income to specific categories

- Sync Across Devices: It allows for synchronization across multiple devices, making it convenient for families or partners to manage their finances together

- Customizable Envelopes: Users can create custom envelopes for various spending categories, such as groceries, rent, and entertainment.

- Expense Tracking: The app provides a platform for logging and analyzing expenses, which helps in maintaining control over spending.

- Savings Goals: Goodbudget supports savings goals, which can be tracked alongside daily expenses.

- Debt Tracking: It includes features to help users track and manage their debts effectively.

- No Bank Linking Required: Transactions are input manually, which can be a plus for those concerned about privacy.

| Goodbudget | Details |

| iOS | Rating: 4.7/5 stars |

| Android | Rating: 4.2/5 stars |

| Cost | Offers a free version with limited features and a premium version at $10 per month or $80 annually. |

| Downloads | 1M+ |

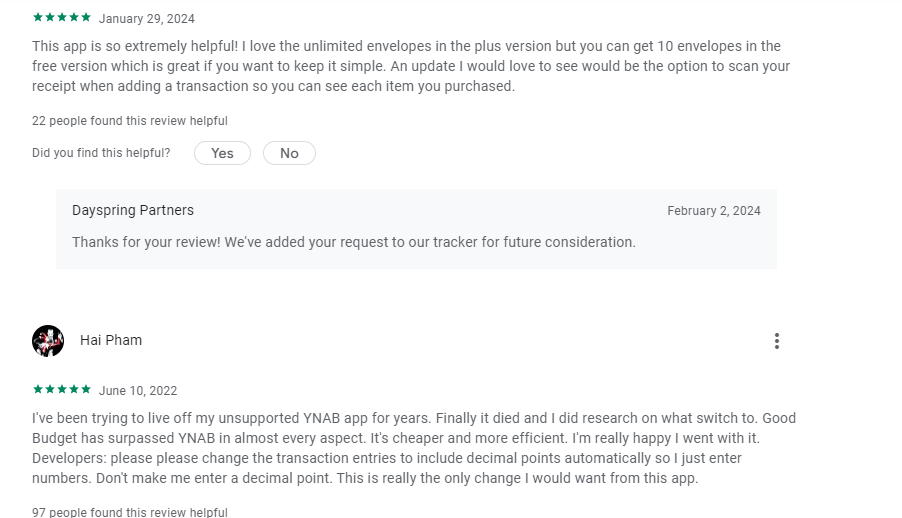

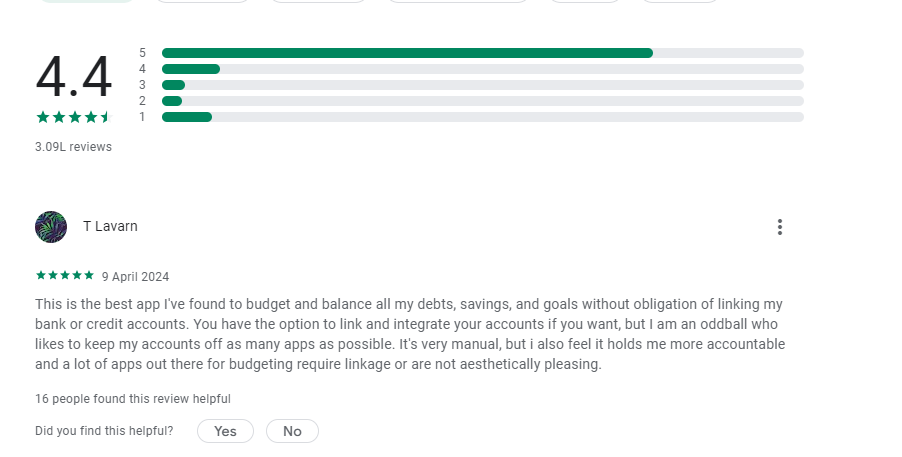

User Reviews

Overall, Good budget is a robust app that offers a practical solution for budgeting and financial management. Its emphasis on the envelope system, combined with modern digital convenience, makes it a popular choice among users who prefer a hands-on approach to managing their money. While it may have some limitations in the free version, the paid version offers expanded capabilities for those with more extensive budgeting needs.

Read: A Guide to Compound Interest Schemes in India

3. Realbyte Money Manager App

The Realbyte Money Manager app is designed for detailed and comprehensive financial tracking. It offers a user-friendly interface and powerful budgeting features.

Moreover, the app’s double-entry bookkeeping system is a standout feature that appeals to those who appreciate detailed financial tracking. Its comprehensive budgeting tools and instant statistics provide users with a clear picture of their financial health, enabling better decision-making.

Features of Realbyte Money Manager App

- Double-Entry Bookkeeping: Ensures accurate financial records and efficient asset management.

- Budget and Expense Management: Visual graphs display budget and expenses, aiding in quick financial assessments.

- Credit/Debit Card Management: Tracks payment amounts and outstanding payments, with options for automatic debit.

- Passcode Protection: Secures financial data with a passcode.

- Transfer and Recurrence Functions: Facilitates easy management of salary, insurance, term deposits, and loans.

- Instant Statistics: Provides immediate insights into expenses by category and monthly asset changes.

- Bookmark Function: Allows for quick entry of frequent expenses.

- Backup/Restore: Offers backup in Excel format and easy data restoration.

- User-Friendly Interface: Designed for ease of use, with improved calendar visuals and aesthetically pleasing charts.

| Realbyte Money Manager | Details |

| iOS | Rating: 4.8/5 stars |

| Android | Rating: 4.6/5 stars |

| Cost | Free for everyone |

| Downloads | 10M+ |

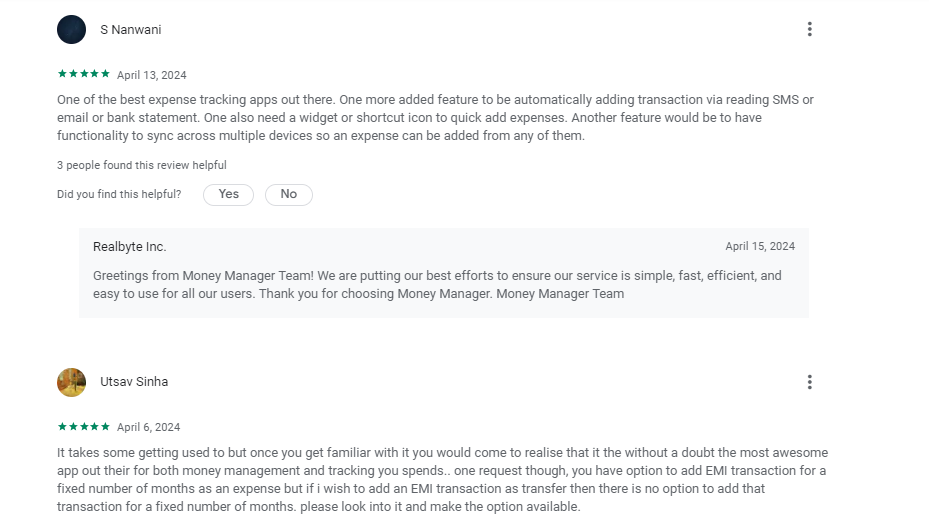

Users Review

It is a powerful budget tracker app for those looking to take control of their personal and business finances. With its robust features and positive user feedback, it stands out as a reliable and user-friendly option for budgeting and expense tracking.

4. Monefy – Budget Manager and Expense Tracker App

Monefy is a sophisticated budget tracker app that simplifies the process of tracking your daily expenses and helps you identify spending patterns. It empowers users to save money by providing a clear overview of their finances. The app’s design focuses on speed and ease, allowing for rapid entry of transactions and immediate visualization of expenses through charts and lists.

Key Features

- Intuitive Interface: Monefy offers a user-friendly interface that allows for quick transaction entries.

- Multi-Currency Tracking: It supports tracking expenses in various currencies, making it versatile for international users.

- One-Click Data Backup: Users can backup and export their personal finance data with a single click.

- Passcode Protection: Ensures the security of your financial information with a passcode lock.

- Customizable Categories: Manage your expenses with custom or default categories to suit your needs.

- Synchronization: Safely syncs data across multiple devices using Google Drive or Dropbox.

- Widgets: Handy widgets provide easy access to your expense tracker.

- Built-in Calculator: Crunch numbers quickly with the integrated calculator feature.

| Monefy | Details |

| iOS | Rating: 4.7/5 stars |

| Android | Rating: 4.2/5 stars |

| Cost | Monefy’s free version covers essentials, while the $2.48 Pro version adds password protection, Dropbox Sync, category customization, and icon changes |

| Downloads | 5M+ |

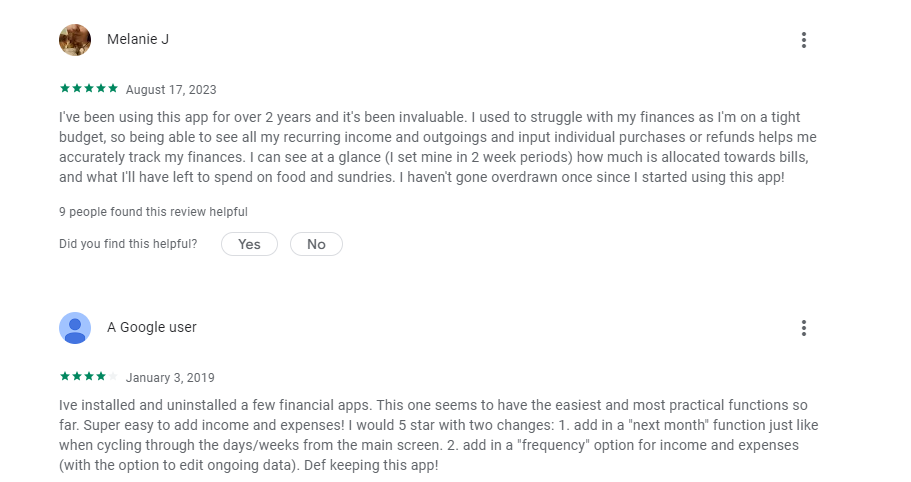

Users Review

5. Wallet – Money, Budget, Finance & Expense Tracker App

Wallet is an all-in-one finance app that not only tracks your expenses but also helps you plan your budget and monitor savings with comprehensive reports.

It’s designed to help you gain full control over your money by offering continuous insights and dynamic reports. The app’s ability to sync with a wide range of banks and its user-friendly interface make it an excellent choice for those seeking a practical and efficient financial management tool.

Key Features

- Automatic Bank Updates: Transactions are automatically synced with your bank accounts and cards, saving you the hassle of manual entry.

- Flexible Budgets: Create and adjust budgets to control your spending and meet your financial goals.

- Savings Management: Plan and manage your savings to secure your future.

- Bill Tracking: Keep track of monthly bills and subscriptions to avoid late payments.

- Cash Flow Monitoring: Get a clear view of your cash flow and balance trends.

- Stock Tracking: Monitor your stock portfolio alongside other financial accounts.

- Insightful Reports: Receive detailed reports and financial tips to better understand your spending.

- Customizable Dashboard: Tailor the dashboard to focus on what’s most important to you.

- Shared Accounts: Collaborate on budgets with family and friends by sharing selected accounts.

| Wallet | Details |

| iOS | Rating: 4.6/5 stars |

| Android | Rating: 4.4/5 stars |

| Cost | Monefy’s free version covers essentials, while the $2.48 Pro version adds password protection, Dropbox Sync, category customization, and icon changes |

| Downloads | 50L+ |

Users Review

Conclusion

Budget tracker apps have become essential tools for anyone looking to get control of their spending and achieve financial wellness. In India, where financial literacy is increasing, these apps provide useful resources for controlling costs, creating budgets, and planning for the future. Whether you’re a college student, a young professional, or an experienced investor, there’s a budget tracker app for you. By leveraging technology, you may streamline your financial management process and work toward a brighter financial future.